By Chris Meehan, Solar Reviews

In all the solar sector drew almost $10 billion in venture capital, debt and public market financing in 2013, up 25 percent from the $8 billion it raised in 2012. That’s according to clean energy consulting firm Mercom Capital Group’s “2013 Solar Annual and Q4 Funding and M&A Report,” which found that while venture capital funding was down for the year, following recent trends.

“While venture funding levels were down, overall fundraising was up and public market financings were really strong in 2013,” said Raj Prabhu, CEO of Mercom Capital Group. “Higher valuations among public solar companies have opened up the capital markets again as an avenue for fundraising at attractive terms. IPOs are back.”

The report found that public market financings grew significantly in 2013, to $2.8 billion in 39 deals in 2013. “Up from just $893 million in 23 deals in 2012. In 2013, there also were seven IPOs that together brought in more than $1 billion.”

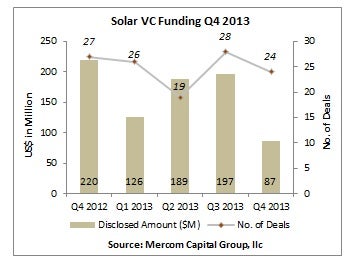

The report found that venture capital funding, which often helps startups move their technology from research or test stages to production was only $600 million, falling 40 percent from the $992 million in such deals in 2012. The report found that 97 venture capital deals were completed in 2013 compared to 106 in 2012. In the fourth quarter of 2013 venture capital spending in solar power was $87 million, less than half the $197 million in previous year’s quarter.

Downstream solar companies, including installers, saw the largest portion of venture capital deals, led by the $69 million raised by Chinese solar project developer Heifer Golden Sun Technology and the U.S.’s Clean Power Finance, which raised $62 million, Mercom said.

It was also a big year for big projects. “Large-scale project funding announced in 2013 amounted to $13.6 billion in 152 deals, compared with $8.7 billion in 84 deals in 2012,” Mercom said. The largest such deal was the $1 billion bond issuance for the 579 megawatt Solar Star 1 and 2 projects owned by MidAmerican Energy Holdings. Overall that sector of the solar industrydrew $13.6 billion in funding in 152 deals up significantly in both the number of deals and funds raised from the $8.7 billion raised through 84 deals in 2012.

Mergers and acquisitions were also up for the year, fetching $12.7 billion in 81 transactions. Most were strategic acquisitions and purchases of distressed assets as 28 companies filed for insolvency or bankruptcy. The largest purchase was Applied Materials’ $9.4 billion acquisition of Tokyo Electron, Mercom said.