COVID-19 has negatively impacted employment in every sector, but the clean energy sector has been hit particularly hard, losing over 620,000 jobs in the US, according to a recent E2 study.

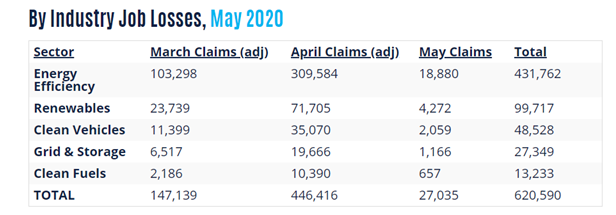

The analysis of Department of Labor data found that 620,590 workers in clean energy occupations, representing 18.5% of the industry’s workforce, filed for unemployment benefits in March, April, and May. The number of jobs lost is more than double the number of clean energy jobs created since 2017.

Before March, clean energy had been one of the U.S. economy’s biggest and fastest-growing employment sectors, growing 10.4% since 2015 to 3.4 million jobs at the end of 2019. That made clean energy by far the biggest employer of workers in all energy occupations, employing nearly three times as many people as the fossil fuel industry.

79% of business leaders in the US said the pandemic has had a moderate to large negative impact on their company. 46% said furloughs, reduced hours, lay-offs, or closing their doors will be necessary when current funding sources are exhausted.

To get a better sense of how the COVID-19 pandemic is affecting CleanTech Alliance members, we asked five questions to gauge how our members are faring.

Leif Elgethun is the Founder & CEO of Retrolux. He drives Retrolux’s strategic vision and manages investor relations. Before Retrolux Leif was involved in several clean energy startups, including: Bluebird Solar and Light, Site Based Energy, Intermountain Energy Partners, and E-Newables.

Jim Mothersbaugh is the President of Water Tectonics. Water Tectonics designs and manufactures water treatment solutions for clients in oil & gas, mining, industrial, and construction applications. The company specializes in innovative electrocoagulation and electrochemical technologies and integration within larger solutions.

Virginia Emery is the Founder and CEO of Beta Hatch. Beta Hatch’s insect-rearing technology converts mealworms and their waste into high-value proteins, oils, and nutrients for agriculture. Their IP enables insects to cost-effectively meet the global scale of demand for animal feed and crop fertilizer.

Reeves Clippard is the President & CEO of A&R Solar. A&R Solar specialize in deploying solar energy technologies for homeowners, businesses, communities, and governmental agencies — to date, A&R has completed more than 2,500 solar installations throughout the Pacific Northwest totaling over 25 megawatts.

Q: What lasting impacts will COVID have on your employees and workplace?

Leif: We had a flexible workplace before COVID, had remote workers, and used lots of remote work technology. The main change is we went 100% remote and moved out of our office. We may get an office again when we have a larger team and determine we actually need an office. I think the default to no office is now the new norm.

Jim: We can easily work from home to our engineering, planning and sales calls.

Virginia: We’ve maintained operations since the beginning of the pandemic so since we’re essential, we’ve been open. We naturally have a high standard of cleanliness due to some of the allergens we work with so we didn’t need to make as many adaptations as you might expect. How we work with each other has changed though, with more remote work and video calls.

Reeves: There are a number of lasting impacts from COVID to our business; both positive and negative. Bad news first is that we did have to lay off some staff as Washington’s Stay Home Stay Safe order went into place. We have been lucky to be able to preserve most of our staff, but some people did lose their jobs. Solar energy has a lot of growth in its future, but that doesn’t make it any easier to lose talented people now. The fear and uncertainty has taken a toll on all of us. Luckily humans are very resilient and one day this pandemic will be a distant memory.

Q: Have you had to lay-off or furlough any of your employees due to COVID?

Leif: We furloughed 50% of our team initially but have brought them all back again.

Jim: None

Virginia: We have not. We’ve made a few restructuring decisions but not related to the pandemic.

Reeves: Yes, see above.

Q: What has been the net impact on your full-time equivalency since the pandemic began?

Leif: Currently we have no net impact.

Jim: None

Virginia: We’ve maintained our full-time equivalency.

Reeves: Initially, our full-time equivalency was negatively affected but, on the positive side, COVID has renewed our focus on “safety first” across the company. We have launched new staff training initiatives and have been working hard to remove waste and mistakes from our processes. We’ve adopted and improved tools to do more of our sales, design, and project management remotely. These efforts have decreased our vehicle miles driven and made our operations more efficient. We’ve always had a strong culture of working flexible hours and remotely for our office staff. Working in the pandemic has strengthened many of the ways we collaborate, but it has also reinforced a divide between our office staff and our installation crews who are having to shoulder additional risk in their day-to-day jobs.

Q: How long do you think it will take your business to fully recover/will it ever recover?

Leif: We’ve almost completely recovered and expect to completely recover by end of Q3 with growth in Q4

Jim: We saw a small growth in 2020 and expect the same for 2021

Virginia: We’ve experienced a six-month delay and have had to redirect our time and energy. Construction work has been delayed and we’ve encountered financing limitations. The 6-month delay due to pandemic had a significant financial impact on us and although we received a PPP loan, it was nominal compared to the scope of the impact. We keep moving ahead but feel confident we can get back.

Reeves: Recovery will likely be lumpy for us. We already call our industry the “solarcoaster” due to the many ups and downs triggered by incentive policy, tariffs, supply chain, and macroeconomic forces. This is another loop on the ride. Most of our residential customers are middle class professionals. In some ways people are connecting with how they live their lives in their home–and how they consume energy–in different ways which is driving new interest in home solar and storage. In other ways, there is still a lot of uncertainty about the economy, employment, safety, and politics in the US. That uncertainty affects our commercial clients in similar ways where it can be hard to commit to long term investments with so much unknown in the short term.

Q: What does “recovery” look like for you and your business?

Leif: We’re measuring recovery in two primary ways which are platform usage and revenue. We saw a 90% drop in platform usage at the low and then had our best month ever in July. We saw our revenue dip 40% in Q2 and are on track to see revenue fully recover in Q3.

Jim: A little slower but positive

Virginia: Getting back to our previous schedule. We hope our facility will be up and operational for Q1 of 2021. Our new facility design has been modified for social distancing so in some ways, we’re not going back to the way things were. From a business standpoint, we’ve had an increase in interest in what we’re doing. Demand has surged but supplies have been limited.

Reeves: At the end of the day I’m very optimistic about long term recovery for our industry. Interest in solar and energy storage is at an all-time high, and the growth needed to meet 100% clean energy goals is more than A&R Solar could ever take on by itself. As we say in solar, the future looks bright!

COVID/Employment Stats:

- More than 620,000 U.S. clean energy workers have lost their jobs since March

- 620,590 workers in clean energy occupations, representing 18.5% of the industry’s workforce, filed for unemployment benefits in March, April, and May.

- The number of jobs lost is more than double the number of clean energy jobs created since 2017.

- The majority of clean energy firms in the U.S. are small businesses, according to the U.S. Small Business Administration (SBA).

- The construction sector (the largest segment of the clean energy economy) is the largest recipient of PPP loans, at more than 13 percent.

- Before March, clean energy had been one of the U.S. economy’s biggest and fastest-growing employment sectors, growing 10.4% since 2015 to 3.4 million jobs at the end of 2019.

- Renewable electric power generation was also hard hit, losing nearly 4,300 jobs which represents an additional nearly 1 percent drop in employment to 16.9 percent since March. This accounts for 16 percent of the May clean energy job losses. Renewable electric power generation has lost 100,000 jobs since the beginning of the pandemic.

- Clean vehicles and clean transmission, distribution, and storage both lost 1 percent of their workforces over the month of May, now at an 18.3 percent decline from its pre-pandemic level. This represents 2,100 and 1,200 lost jobs in May, respectively. The complete impact of the pandemic on clean vehicles and clean transmission, distribution, and storage totals 46,500 and 26,200 lost jobs thus far.

- Clean fuels fared the best, losing 700 jobs over May, representing a less than 1 percent employment decline over the month. This represents more than 2 percent of clean energy job losses over May. Clean fuels have lost 13,200 jobs since the start of March, or 12.6 percent decline.

- Full report here