Note: This is Joe Borich’s report on the March 2012 Cleantech Study Mission to China. The trip began in Seattle and proceeded to Beijing and Shanghai. Nearly two dozen participated in the trip.

Joe’s complete trip notes can be found here.

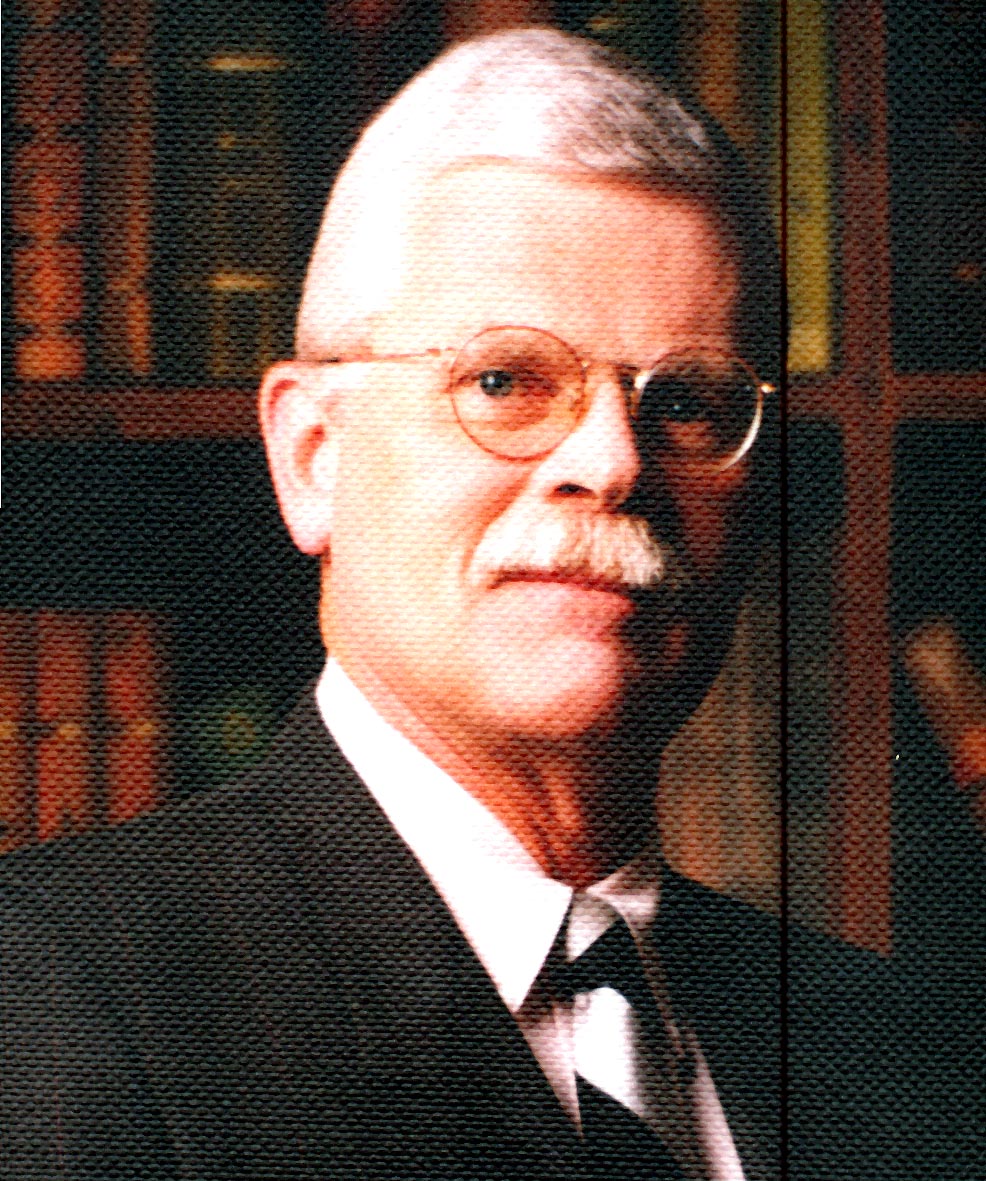

Joseph J. Borich is President of the Washington State China Relations Council. Prior to his current position, Joe was a Foreign Service Officer beginning his career in 1972. He has been closely associated with China throughout most of his career, serving under every president from Nixon to Clinton in a China-related capacity. His last assignment was as Consul General in Shanghai from 1994 through 1997; he previously helped open this Consulate General in 1980. He also served as Director of the Taiwan Coordination staff in the Bureau of East Asian and Pacific Affairs in the Department of State, and prior to that as the last Deputy Chief of Mission in the former U.S. Embassy in Mogadishu.

Washington State has become a global leader in clean technology including alternative energy sources, energy and water efficient building construction, smart grid and smart city technology, and biotechnology. Jointly organized by the Washington State China Relations Council, the Trade Development Alliance of Greater Seattle, the Washington Clean Technology Alliance, and the Northwest Energy Angels, the purpose of the business mission was to give clean tech practitioners and investors from our area a look at China and what it’s doing in the clean tech area, as well as to examine opportunities for cooperation and investment.

Our delegation met with the U.S. Embassy, the State Council’s Development Research Center (the Chinese government’s top economic think tank and responsible for the inputs to the five-year plans), energy and clean tech consulting firms, China’s State Grid (its principal power company with over one billion customers), wind, solar, and battery companies, and several clean tech-focused venture capital firms.

Thoughts from American Businesses in China

At the 30,000 foot level, we learned that American businesses operating in China are for the most part optimistic about their near-to-mid term prospects. Fifty-four percent of those polled by the American Chamber of Commerce are already expanding, or plan to expand, to second- and third-tier cities in China. Basic optimism aside, American businesses remain concerned about inadequate protection for their intellectual property (including brands, patents, and proprietary technologies); the availability of human resources and the rising cost of labor; obtaining necessary certifications and approvals; and the somewhat uncertain and oft-changing regulatory environment.

Notable Trends

Among the significant economic trends currently present in China are a slowdown in GDP growth this year and next (although there seems to be little concern about a hard landing). Along with slowing growth, China’s foreign exchange reserves are also declining in part because of China’s shrinking global trade surplus and also because of a rising tide of outbound direct foreign investment by Chinese firms. Slowed growth is partly due to declining exports and slowing construction; but the central government’s renewed efforts to rebalance China’s economy is also likely a factor. By 2010, China’s top leadership had reached the conclusion that growth driven principally by fixed asset investment and exports was rapidly becoming unsustainable, a lesson driven home by the ripple effects of the global financial crisis of 2008-2009.

Rebalancing is intended to turn growth more in the direction of domestic consumption. This in turn requires that China invest more in items like health care, education assistance, social security/retirement, and low cost housing, programs for which there are still relatively few beneficiaries in China. As a result, the propensity to save among Chinese is off the charts at over 40% of income, while the propensity to consume is very low (domestic consumption accounted for only 35% of China’s GDP last year – less than half the proportion of developed countries). The adjustments necessary to rebalance the economy, however, will slow growth at least in the short run, and also collide with the vested interests of huge state owned enterprises and conservative elements in the Chinese Communist Party who prefer strong central control of the economy and the political system. Although rebalancing is an integral part of the current five year plan (2011-2015) as it was in the previous one, relatively little headway has been made so far.

Urbanization is another compelling trend in China today. For the past decade and for the next decade at least, average annual rural to urban migration has been and will continue to be around 20 million. In 2010, there were 171 cities in China with a population of one million or more; about 47% of the entire population lived in cities then. Plans call for an urban population constituting 51% of the total by 2015, but recent figures released by China indicate they may have hit that target already. This demographic trend has several important implications, not the least of which being that between now and 2030 China will have to expand its urban environment by roughly the equivalent of the population of the U.S. It also portends a dramatic increase in energy intensity since urban residents use far more energy than their rural counterparts.

Along with the pressures of urbanization and the need to rebalance the economy, China’s leadership is also facing growing discontent from the widening income gap (as one example of this rural residents’ incomes are only 1/5 of that of urban residents), the inequitable household registration system that disadvantages rural residents and those who have unofficially changed their residences to the cities (most rural-to-urban migrants fall into this category), and the cumulative effects (including those on health) of China’s badly damaged environment. Over the next 12 months, China’s leadership lineup will undergo a major change; the new lineup will be faced with the daunting task of effectively addressing these issues, and will likely have to do so sooner rather than later.

China’s Five-Year Plan and Clean Technology

We learned about China’s current (12th) Five-Year Plan from several sources. Of particular interest to our group were the presentations on the plan’s treatment of low carbon development. China now leads the world in petroleum importation – over 50% of the oil it uses today is imported. That figure will grow to 70% by 2020. China’s use of fossil fuels is creating huge problems for China’s environment including pollution-based health problems and rising morbidity/mortality rates, and other problems like acid rain.

To try to address these problems, China has adopted some ambitious goals, including:

- Reducing carbon emissions per unit of GDP by 40-45 percent by 2020, compared to 2005;

- Boosting non-fossil fuel energy sources to 15 percent of all energy by 2020; and

- Substantially increasing forestation in China.

What does “low carbon development” mean in China?

The 12th Five Year Plan specifies by 2015:

- Reducing carbon intensity by 17%;

- Substantially reducing energy consumption in industry, in particular in such high energy consumers as the steel industry (government subsidies will be employed to help meet this goal);

- Improve building construction and consumer energy use;

- Boost wind power as an energy source from 40 GW in 2010 to 100 GW;

- Increase the use of solar energy from 0.3 GW in 2010 to 15 GW;

- Carry out energy pricing reforms for electricity and gas;

- Deploy some form of carbon trading, although what system exactly will be used – e.g., cap and trade – is still much disputed as is the use of a carbon tax.

A special emphasis will be placed on relevant industries (including, presumably, subsidies, tax incentives, and other government tools for promoting rapid development): new energy; the environment; autos (especially EVs); modern knowledge technologies; biotech; and high speed transportation. In all, these favored sectors will constitute 8% of GDP by 2015 and 15% by 2020.

Building energy efficiency standards are currently good, but are not well enforced. This is changing for the better even as stricter standards are being adopted. Also energy pricing is being further rationalized and carbon trading is being gradually introduced. The government has set the goal of one million Electric Vehicles on China’s roads by 2015, though this goal is probably too ambitious.

China has long maintained an industrial policy, attempting to pick winners and losers among various industries and within industries, among competing state owned enterprises. The 12th Five-Year Plan identifies seven strategic industries that will enjoy government patronage:

- Energy conservation and the environment

- New energy

- Electric vehicles

- Biotech

- Medical technology

- Next generation IT, and

- New materials

Clean Energy and Power Supply in China

State Grid, China’s largest power company covering 88% of the country’s area, is the largest utility in the world and last year distributed over 2700 terawatt hours of electricity. The company is concentrating its efforts on overall construction of a smart grid by 2015. China currently has the most advanced system in the world for using UHV transmission and non-fossil fuel energy sources (and is way ahead of the U.S.). State Grid is also building a fiber optic network form smart grid information/dispatch that will also be used eventually to carry telephone, cable TV and other signals a well.

China is also doing very advanced work with battery technology, both for energy storage and for commercial use in consumer items and EVs. Prudent Energy Company, for example, has developed a storage battery based on use of a vanadium electrolyte. This type of battery poses little or no environmental risk and is nearly 100% recyclable. Each battery has a lifespan of 15-20 years and is ideally suited for storing and stabilizing wind and solar power.

Lishen Battery Company is using improved lithium ion technology to make batteries for electronics manufacturers (including Foxconn and Dell), as well as EV batteries. Lishen batteries currently power a vehicle for up to 200 KM (125 miles) between charges, but new technology the company will soon be incorporating into its batteries will double the distance between charges. Lishen has been cooperating with Washington State’s Demand Energy for the past two years on smart grid and energy storage to develop distributive energy systems.

Venture Capital

Among the venture capital firms we met there are differing investment strategies. Chrysalix, a clean tech-focused, ten-year old investment fund, looks for returning Chinese students and academics that are bringing back with them new technology ideas with commercial possibilities. In addition to providing capital, Chrysalix also helps nurture and manage the startups in which they invest, focusing, in particular, on protection of proprietary technology.

Tsing Capital, on the other hand, invests predominantly in early growth stage companies where the technology has already been commercialized with some initial product sales. They are not interested in basic technology still under development, such as Chrysalix. Moreover, virtually all of their investments are in foreign origin/owned technology (although frequently with some Chinese modifications). This also distinguishes their investment model from Chrysalix’ whose technologies are predominantly Chinese owned albeit by returning Chinese students.

Concluding thoughts

And finally, a sampling of some random thoughts from the consulting firms with which we also visited.

- Although energy – and in particular, clean energy – grabs most of the attention focused on China these days, the most critical issue facing China by far in the decades ahead is water. With only 2100 cubic meters of water per person, China’s available water is only ¼ the global average and is not evenly distributed.

- Over the next 20 years, China will add 50 new cities of over one million people; fifty thousand more skyscrapers; and 170 more mass transit systems. In that time, one of every two new buildings constructed in the entire world will be in China.

- As a talent pool base, Shanghai has become China’s Silicon Valley. Students along with overseas Chinese academic “A” players returning from abroad are being offered incubators for their new ideas, high salaries, and generous allowances. Academics are also given high status and recognition and the opportunity to run their own labs staffed with top graduate students. Despite this influx of returning “sea turtles,” qualitative improvements in Chinese innovation and creativity are likely to be made only gradually over time.

The clean tech mission participants – most of whom had not been to China before – were uniformly impressed by what they found there. For all the progress that China has made over the past thirty years – and no country in history has ever experienced more growth and development in such a short period of time – there is still a very long way to go, as we also discovered. But, in the area of most interest to our group, clean technology, China is on the way to becoming a world leader. For us, this presents both opportunities and challenges.

For more information, including the WSCRC’s trip to Chongqing, click here.

For more observations from the trip, please visit these links from the other organizers of the business mission and delegates.