The Obama administration is reviving a green-technology loan program that became a magnet for GOP political attacks following the bankruptcy of Solyndra in 2011.

Solyndra was among a number of green-energy or auto companies backed by the Obama administration that either collapsed or struggled badly, turning the program into a punching bag for Republicans and sparking GOP-led congressional probes.

But the White House and its allies have long said the program has been a big success in the main despite some flops.

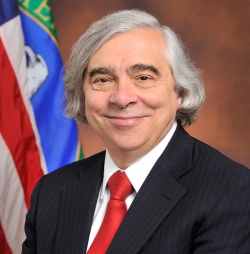

Energy Secretary Ernest Moniz, on the job since mid-2013, has been a staunch defender of federal green-tech loan programs and now his plan to revive them seems to be picking up speed.

On Wednesday Moniz said that the department would probably throw open the door to new applications for renewable-energy project loan guarantees during the second quarter of this year, a somewhat more precise forecast than his previous estimate of “relatively soon.”

Also Wednesday, the Energy Department said it’s rebooting the separate Advanced Technology Vehicles Manufacturing (ATVM) loan program in preparation for offering the first new loans in years.

That program has previously supported Ford, Nissan, and the electric-vehicle companies Tesla, which repaid its loan ahead of schedule, and Fisker, which fell apart after drawing nearly $200 million in federal loans (DOE recovered $53 million, and the company is now under new ownership).

That program has previously supported Ford, Nissan, and the electric-vehicle companies Tesla, which repaid its loan ahead of schedule, and Fisker, which fell apart after drawing nearly $200 million in federal loans (DOE recovered $53 million, and the company is now under new ownership).

DOE’s loan-programs office, in a letter today to auto equipment makers, announced that projects to manufacture a “broad range” of component technologies are eligible for loans.

The ATVM program, which according to the department can provide another $16 billion worth of new loans, also said it has taken steps to make the application process faster and more responsive.

“Motor vehicle parts manufacturers play a significant role in the development and deployment of new technologies to meet the demand for fuel-efficient vehicles and we believe the ATVM Loan Program can play an important financing role as the industry establishes the next generation of manufacturing facilities in the United States,” Moniz said in a statement.

The loan programs for low-emissions technology projects and green-car manufacturing were first authorized in bipartisan 2005 and 2007 energy laws. But loans for renewable-energy projects, aided by the 2009 stimulus law, didn’t begin until Obama was in office. Nor did the ATVM loans.

In 2009-11, the two programs supported automakers and an array of solar and wind-power projects, a few solar-equipment makers (including Solyndra), and other ventures.

The department recently finalized a loan guarantee for a nuclear power project in Georgia, and it’s taking applications for petroleum- and coal-related projects that trap carbon emissions.

For the next wave of loan guarantees, however, the department won’t have as much money to work with as it did several years ago, when it backed big projects like the massive Ivanpah solar station in California.

Peter Davidson, the head the DOE loan program, recently suggested that a focus of the revived program would be initiatives that help integrate renewable power onto the grid, as opposed to big power-generation projects.

While political attacks against the loan program have died down, they haven’t gone away entirely, as Republicans continue to argue that the green-tech loan programs have been wasteful, unneeded, and poorly run.

Indeed, the House Republicans’ budget plan unveiled this week would block future loans. But the proposal is only a symbolic statement of party principles; the topic is no longer front-and-center for the House GOP, at least for now.

And while the program has taken its lumps, Republicans who used two House committees to probe it never uncovered evidence to support their most salacious claims.

In particular, a lengthy Energy and Commerce Committee probe completed in August 2012 didn’t back up accusations—echoed often by Republicans and their allies on the 2012 campaign trail—that federal loans to Solyndra and other projects were rewards for political donations.

The investigations did unearth revelations and internal documents that were embarrassing and politically damaging for the Obama administration, such as emails showing pressure to finalize the Solyndra deal despite internal concerns.

Moniz, however, is seeking to play offense in support of the loan program. He’s happy to make the case that the overall loan portfolio is performing strongly.

“We have been taking the position quite consistently—and we’re happy to discuss it any place, any time—that the program as a portfolio has done extremely well,” Moniz told reporters after testifying on Wednesday before the GOP-led House Appropriations Committee in a two-hour-plus hearing that was free of attacks on the program.

The $30 billion-plus portfolio’s losses have been about 2.5 percent, according to the Energy Department. Moniz noted that the program has used only a small amount of the “loan loss reserve” that Congress provided.

He even saw room for some loan-program humor.

“Maybe I’m worried that the arguments will change,” Moniz told reporters. “That we’re not taking enough risk.”