By Benjamin Leffel

The Tai Initiative

|

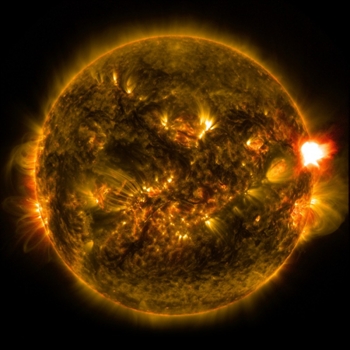

| Credit: NASA |

In early 2015, the International Trade Commission (ITC) investigation Certain Crystalline Silicon Photovoltaic Products from China and Taiwan concluded with the decision to impose anti-dumping and countervailing duties against crystalline silicon photovoltaic (CSPV) products imported from China and Taiwan. In short, this outcome means that U.S.-based solar cell manufacturers should have a better shot at exporting in the solar market, and favors the possibility of new growth in solar manufacturing in the U.S. The alternative outcome, which I wrote about in an earlier article, would have favored continued availability of low-priced CSPV goods for import from China and Taiwan—good for U.S. buyers, bad for U.S.-based CSPV manufacturers.

Prior to the ITC decision, controversy surrounded U.S.-China competition in the solar technology market because China was able to produce more CSPV products and thus sell them at a much lower price than U.S. competitors. While some U.S. importers of solar cells enjoyed low prices, this came at the cost of U.S. solar power systems producers having difficulty competing, and thus creating the opportunity cost of American solar manufacturing jobs that otherwise could have been created and sustained. One such producer was SolarWorld, which in 2013 filed the original complaint that led to the ITC investigation, and has now emerged victorious.

SolarWorld was not the only such U.S.-based solar producer to experience difficulty competing. In November 2014, Toledo, Ohio-based solar panel manufacturer Xunlight Corporation went bankrupt, due primarily to the fact that the price of solar cells had dropped to between a third and a fourth of their value from when the company started. Low-cost Chinese competitors’ CSPV exports were quite likely a large culprit.

|

|

Credit: NASA |

However, now that the ITC has cemented the decision to impose duties against underpriced Chinese competition, U.S.-based solar manufacturers should—presuming the duties against foster the more even playing field intended—have a better shot at competing. In the long-term, the U.S. industrial landscape may become dotted with more solar power systems producers; and as it gains market share, it will be able to export its own higher-quality CSPV materials to China.

You can address this question and more as part of the Tai Initiative 2015 Conference in Washington D.C. Registration is open now.

About The Tai Initiative

Mission: To build real bilateral communication capacity between the U.S. and China at the subnational level (state/city/university/business) by nurturing a network of solid personal relationships upon which the two national governments can lean for achieving successful communication, understanding, and trust.